Losing expensive tools stored in your car can be a devastating blow, both financially and professionally. Knowing whether your insurance covers tool theft from a car is crucial. This article will explore the intricacies of insurance coverage for tool theft, helping you understand your options and protect your valuable investments. Let’s dive in and learn how to safeguard your livelihood. You might be surprised to learn about the specifics of your car insurance and homeowner’s or renter’s policy. We’ll discuss what’s typically covered, common exclusions, and steps you can take to minimize your risk. Check out our article on tools to steal a car to understand potential vulnerabilities.

Does My Car Insurance Cover Stolen Tools?

Car insurance typically covers the car itself and its factory-installed parts. It usually doesn’t cover personal belongings inside the vehicle, including tools. This is where things get tricky. While your car insurance might cover the damage to your car caused by the break-in, it likely won’t cover the stolen tools themselves. However, some comprehensive car insurance policies offer limited coverage for personal property, but often with low limits and high deductibles. It’s essential to thoroughly review your policy or consult with your insurance provider to understand the specifics of your coverage.

Car Insurance Policy Showing Tool Theft Coverage Details

Car Insurance Policy Showing Tool Theft Coverage Details

What About Homeowner’s or Renter’s Insurance?

Your homeowner’s or renter’s insurance might offer better protection for stolen tools, even if they were stolen from your car. These policies typically cover personal property against theft, regardless of location. This means your tools might be covered even if they were stolen from your car parked on the street, in your driveway, or even in a different city. However, coverage limits and deductibles apply here too. You might need to purchase a separate rider or endorsement to fully cover high-value tools. Comparing different insurance options can be overwhelming. You might find our compare NY car insurances tool helpful.

How to Maximize Your Insurance Coverage for Tool Theft

Understanding the nuances of insurance policies is the first step. Contact your car insurance provider and your homeowner’s/renter’s insurance provider to clarify what is and isn’t covered. Ask about specific scenarios and hypothetical situations. For example, would your tools be covered if your car was stolen and later recovered without the tools? Documentation is key. Keep a detailed inventory of your tools, including photographs, receipts, and serial numbers. This will help you file a claim and prove ownership in case of theft. Learn more about tool car window etching as an additional security measure.

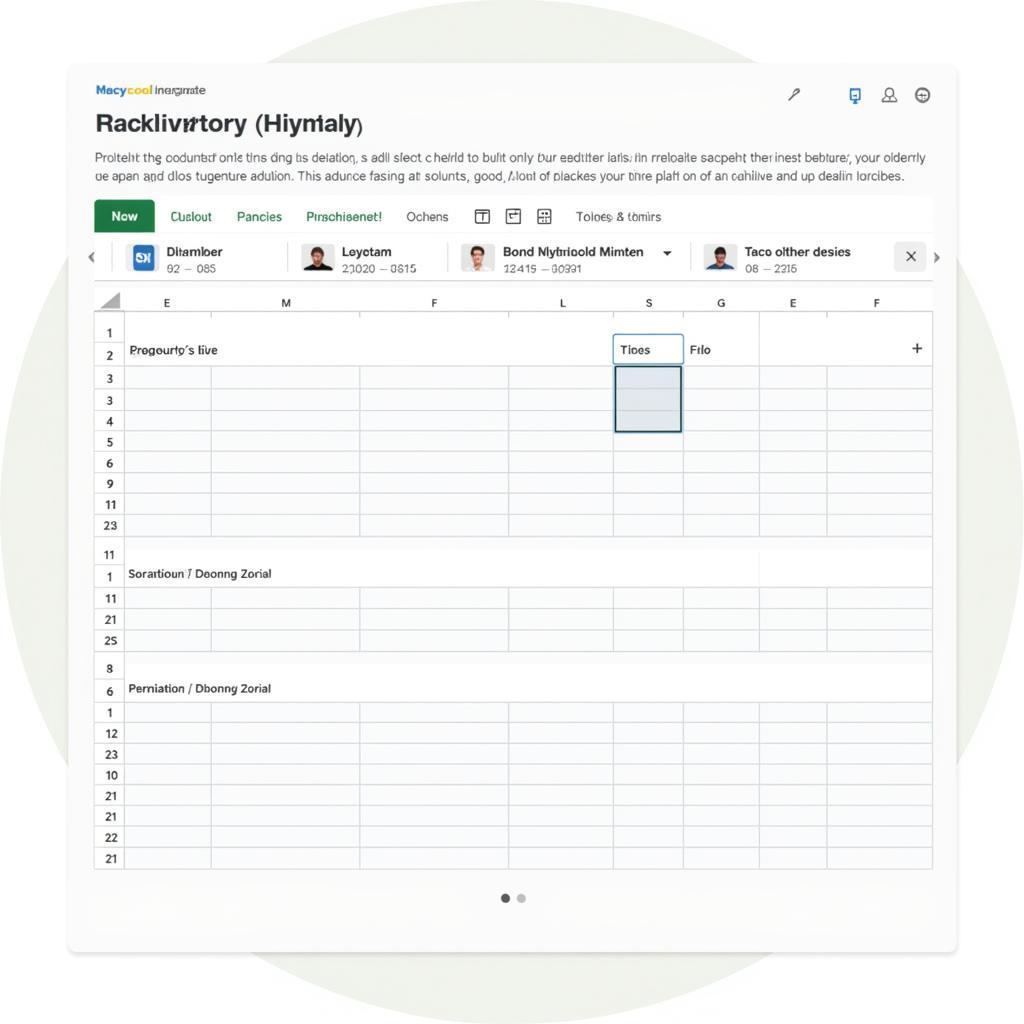

Tool Inventory Spreadsheet for Theft Insurance Claim

Tool Inventory Spreadsheet for Theft Insurance Claim

Will Insurance Cover Tools Stolen From a Locked Car?

Whether your car was locked or unlocked at the time of the theft can significantly influence your insurance claim. While locking your car is always recommended, it doesn’t guarantee coverage. Insurance companies might investigate the circumstances of the theft, including whether there were signs of forced entry. If your car was unlocked, it might be more difficult to prove a theft occurred, and the insurance company might deny your claim. Remember to always lock your car and consider additional security measures like car alarms and car diagnostics plug lock for enhanced protection.

Preventing Tool Theft From Your Car

Prevention is always better than cure. Take proactive steps to minimize the risk of tool theft. Never leave valuable tools visible inside your car. Store them in the trunk or a lockable toolbox, preferably out of sight. Park in well-lit areas and consider using a car alarm. Window etching can also deter thieves. If you’re curious about the cost, see our page on slim jim car tool price.

Secured Tool Storage in Car Trunk for Theft Prevention

Secured Tool Storage in Car Trunk for Theft Prevention

Conclusion

Protecting your tools from theft is vital for your livelihood. Understanding your insurance coverage and taking preventative measures are crucial steps in safeguarding your investment. Be proactive, document everything, and explore all available security options. Insurance To Cover Tool Theft From Car can be complex, so taking these precautions will give you peace of mind.

FAQs

- Does car insurance cover stolen tools from a locked car? It depends on the policy; comprehensive coverage might offer limited protection, but check your specific policy details.

- What type of insurance is best for tool theft coverage? Homeowner’s or renter’s insurance typically provides broader coverage for personal property, including tools, than car insurance.

- How can I prove ownership of stolen tools? Maintain a detailed inventory with photos, receipts, and serial numbers.

- What are some ways to prevent tool theft from my car? Never leave tools visible, use a lockable toolbox, park in well-lit areas, and consider a car alarm.

- Do I need a separate rider for expensive tools? You might need a rider or endorsement for high-value tools to ensure adequate coverage.

- Should I contact my insurance provider to discuss tool theft coverage? Absolutely! Contact both your car and homeowner’s/renter’s insurance providers to clarify coverage details and potential scenarios.

- Is tool insurance worth the cost? Considering the potential financial loss from tool theft, especially for professionals who rely on them for their livelihood, tool insurance can be a worthwhile investment.

Tool Theft Scenarios

- Scenario 1: Tools stolen from a locked car parked in a well-lit parking lot.

- Scenario 2: Tools stolen from an unlocked car parked in a driveway.

- Scenario 3: Car stolen and recovered, but tools are missing.

Related Resources

You might also find these articles helpful:

If you have any further questions or need specialized advice, don’t hesitate to contact us.

Contact Us

For immediate assistance, reach us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit our office at 910 Cedar Lane, Chicago, IL 60605, USA. Our customer service team is available 24/7.

Leave a Reply