A Car Finance Calculator Tool is essential for anyone considering buying a car. It helps you understand the true cost of car ownership by estimating monthly payments, total interest paid, and the overall loan amount. Using a car finance calculator empowers you to make informed decisions, avoid financial surprises, and negotiate effectively with dealerships. Check out resources like the car loan comparison tool to get started.

Understanding the Power of a Car Finance Calculator

A car finance calculator is more than just a number cruncher. It’s your financial compass, guiding you through the complexities of auto loans. By inputting key information like loan amount, interest rate, and loan term, you can quickly see how different factors impact your monthly budget. This knowledge allows you to adjust your expectations and find a car that truly fits your financial capabilities.

Knowing your budget beforehand allows you to confidently walk into a dealership and negotiate the best possible deal. Armed with accurate payment estimations, you can avoid being pressured into a loan you can’t afford.

Key Inputs for a Car Finance Calculator

Using a car finance calculator effectively involves understanding the key inputs required. Here’s a breakdown:

- Vehicle Price: The total cost of the car you plan to purchase.

- Down Payment: The upfront amount you’ll pay towards the vehicle price. A larger down payment can reduce your loan amount and monthly payments.

- Loan Term: The length of time you have to repay the loan, usually expressed in months. Longer loan terms result in lower monthly payments but higher overall interest paid.

- Interest Rate: The percentage charged by the lender for borrowing money. A lower interest rate is always preferable as it minimizes the total cost of the loan.

- Trade-In Value (if applicable): If you’re trading in an old car, its value can be used to offset the new car’s purchase price, reducing your loan amount.

Different Types of Car Finance Calculators

Not all car finance calculators are created equal. There are specialized calculators designed for different financing scenarios:

- Auto Loan Calculator: This is the most common type, used to calculate monthly payments and total interest on a standard car loan.

- Lease Calculator: Specifically designed for car leases, these calculators estimate monthly lease payments and other lease-related costs. You might find tools like the one at thefinancetwins.com tools car-lease-calculator helpful for this purpose.

- Loan Refinance Calculator: If you’re considering refinancing your existing car loan, this calculator can help you determine if refinancing will save you money.

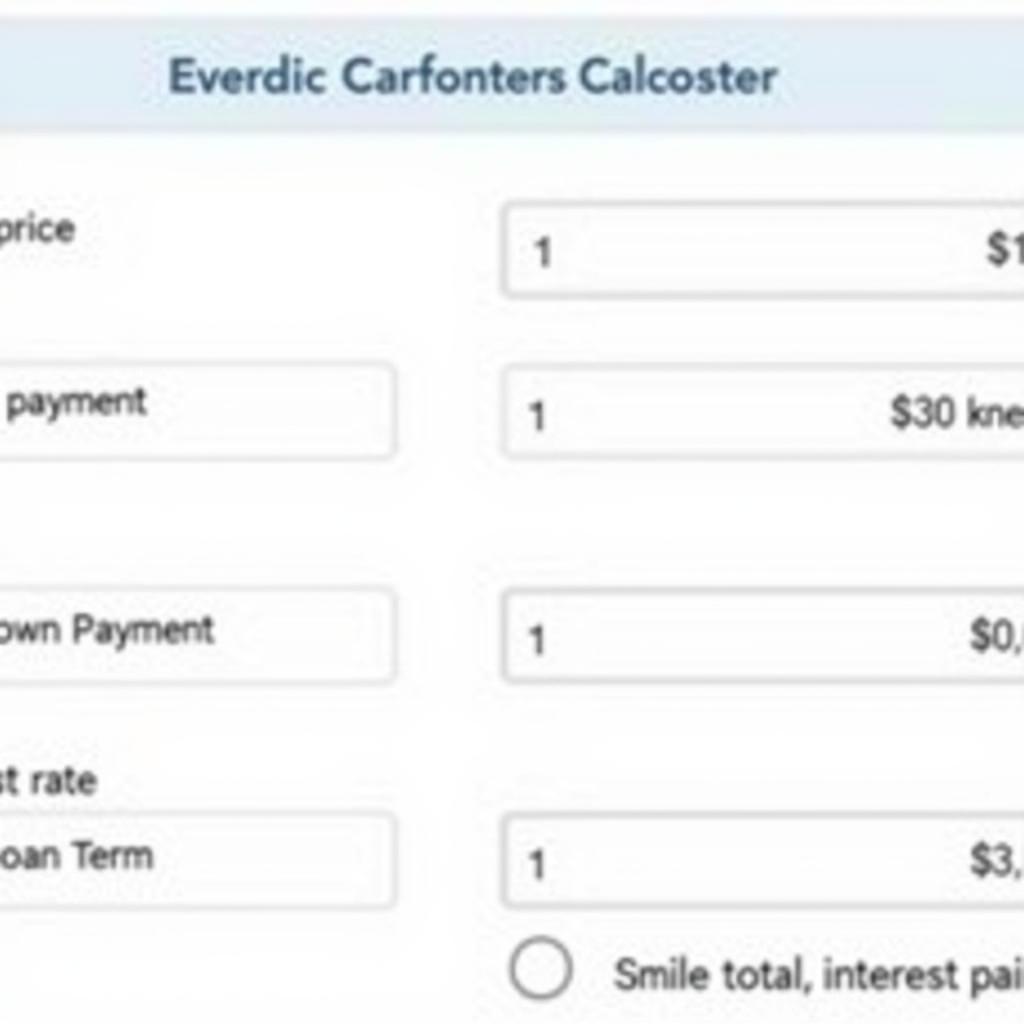

Car Finance Calculator Interface Example

Car Finance Calculator Interface Example

How to Choose the Right Car Finance Calculator Tool

Choosing the right car finance calculator can simplify the car buying process. Look for calculators that are:

- Easy to use: The interface should be intuitive and straightforward.

- Comprehensive: It should provide all the necessary calculations, including monthly payments, total interest paid, and amortization schedules.

- Reputable: Choose calculators from trusted financial institutions or websites like DiagFixPro.

Don’t forget to consider specialized calculators for specific financing needs, such as leasing. Resources like the fidelity investments car tool can be a good starting point.

Benefits of Using a Car Finance Calculator Tool

Using a car finance calculator offers numerous advantages:

- Budgeting: Accurately estimate your monthly car payments and plan your finances accordingly.

- Comparison Shopping: Compare loan offers from different lenders and choose the best deal.

- Negotiating Power: Knowing your budget gives you leverage when negotiating with dealerships.

- Avoiding Financial Strain: Ensure you can comfortably afford the car you choose.

Comparing Car Loan Options with a Calculator

Comparing Car Loan Options with a Calculator

Tools such as the bank of america mobile car shopping tool can be incredibly useful during the car buying process.

What are the common mistakes when using a car finance calculator tool?

Common mistakes include forgetting additional costs like insurance and taxes, not comparing different loan terms, and not factoring in your current financial situation.

What is the difference between APR and interest rate?

APR (Annual Percentage Rate) reflects the total cost of the loan, including fees and other charges, while the interest rate is simply the cost of borrowing the principal. Understanding the difference is crucial. You can learn more about calculating these costs with resources like calculate interest payments tool car loan.

Conclusion

A car finance calculator tool is indispensable when buying a car. It empowers you to make informed financial decisions, negotiate effectively, and ultimately drive away in a car that fits your budget and lifestyle. Understanding how to use this tool effectively will save you money and stress in the long run. Start using a car finance calculator today and take control of your car buying journey!

Happy Car Owner after Using Car Finance Calculator

Happy Car Owner after Using Car Finance Calculator

FAQ

-

What is a car finance calculator tool?

A car finance calculator is a tool that helps you estimate the costs associated with financing a car. -

Why should I use a car finance calculator?

It helps you budget, compare loan options, and negotiate effectively. -

What information do I need to use a car finance calculator?

You’ll need the vehicle price, down payment, loan term, and interest rate. -

Can I use a car finance calculator for leasing?

Yes, there are specific lease calculators available. -

Where can I find a reliable car finance calculator?

You can find reliable calculators on DiagFixPro and other reputable financial websites.

If you need further assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 910 Cedar Lane, Chicago, IL 60605, USA. We have a 24/7 customer support team ready to help.

Leave a Reply