The CareCredit desktop tool offers a convenient way to manage patient financing. This guide dives deep into the features, benefits, and best practices for leveraging the CareCredit desktop tool to maximize its potential for your practice.

Understanding the Power of the CareCredit Desktop Tool

The CareCredit desktop tool is more than just a payment processing platform; it’s a powerful tool designed to streamline patient financing, improve practice efficiency, and enhance the overall patient experience. By integrating seamlessly into your existing workflow, it eliminates the hassle of traditional financing methods, allowing you to focus on what matters most: providing exceptional patient care.

Key Features and Benefits of the CareCredit Desktop Tool

- Simplified Application Process: The user-friendly interface makes it easy for patients to apply for CareCredit financing directly from your office, reducing paperwork and wait times.

- Real-Time Credit Decisions: Get instant approvals, enabling patients to access the care they need without delay.

- Flexible Payment Options: Offer patients various payment plans to suit their individual budgets, promoting treatment acceptance and increasing case acceptance rates.

- Reduced Administrative Burden: Automate payment processing and reporting, freeing up valuable staff time and reducing administrative overhead.

- Improved Cash Flow: Receive payments quickly and efficiently, enhancing your practice’s financial stability.

- Enhanced Patient Satisfaction: Provide a seamless and stress-free financial experience, leading to greater patient loyalty and positive word-of-mouth referrals.

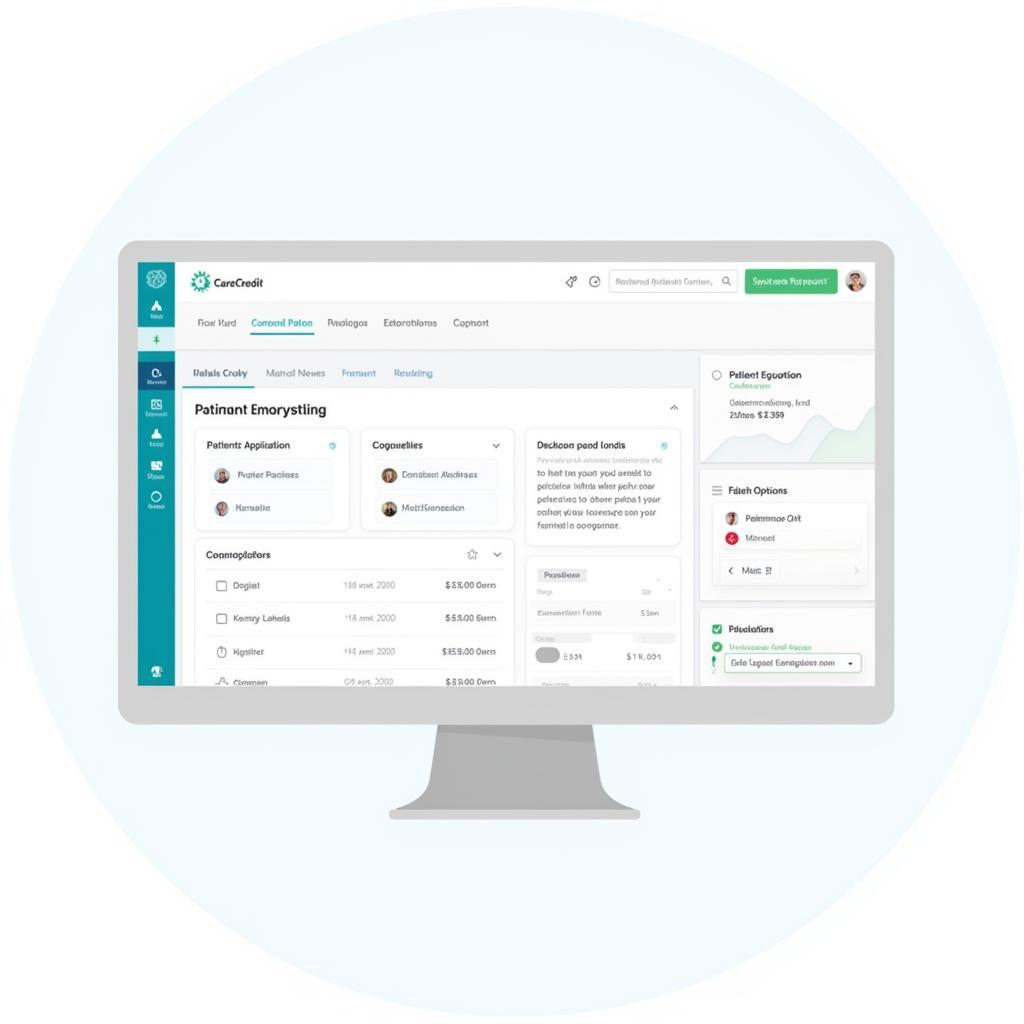

CareCredit Desktop Tool Interface

CareCredit Desktop Tool Interface

How to Effectively Use the CareCredit Desktop Tool in Your Practice

Implementing the CareCredit desktop tool effectively is crucial for maximizing its benefits. Here’s a step-by-step guide to help you get started:

- Staff Training: Ensure your team understands the tool’s functionality and can confidently guide patients through the application process.

- Integration with Practice Management Software: Seamless integration streamlines workflows and eliminates data entry errors.

- Promote CareCredit to Patients: Educate patients about the benefits of CareCredit financing and encourage them to apply.

- Regular Reporting and Analysis: Track key metrics to optimize the use of the tool and identify areas for improvement.

CareCredit Training Session

CareCredit Training Session

Addressing Common Questions About the CareCredit Desktop Tool

What if a patient is declined for CareCredit?

Offer alternative financing options or work with the patient to develop a payment plan that fits their budget.

How secure is the CareCredit desktop tool?

The tool utilizes advanced security measures to protect patient information and ensure compliance with industry regulations.

Can the CareCredit desktop tool be customized for my practice?

Yes, the tool can be configured to meet the specific needs of your practice.

CareCredit Desktop Tool vs. Web Portal: Which One is Right for You?

While both offer access to CareCredit financing, the desktop tool provides a more integrated and streamlined experience within your practice management system. The web portal, while convenient for patients, may lack the seamless integration and reporting capabilities of the desktop tool. Choosing the right option depends on your practice’s specific workflow and preferences.

Maximizing Patient Financing with the CareCredit Desktop Tool

The CareCredit desktop tool empowers practices to offer flexible payment solutions, enhancing patient access to care and improving practice profitability. By leveraging its powerful features and following best practices, you can transform patient financing into a seamless and beneficial aspect of your practice operations.

In conclusion, the CareCredit desktop tool is a valuable asset for any practice seeking to optimize patient financing and streamline operations. By embracing this technology, you can provide patients with affordable care options, enhance your practice’s financial performance, and build lasting patient relationships.

FAQ

- What are the system requirements for the CareCredit desktop tool?

- How do I integrate the CareCredit desktop tool with my existing software?

- What types of training are available for the CareCredit desktop tool?

- What are the fees associated with using the CareCredit desktop tool?

- How can I troubleshoot issues with the CareCredit desktop tool?

- Is technical support available for the CareCredit desktop tool?

- How often is the CareCredit desktop tool updated?

For further assistance with car diagnostic tools and software, explore our other articles on DiagFixPro.

If you need further assistance, don’t hesitate to contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 910 Cedar Lane, Chicago, IL 60605, USA. We have a 24/7 customer support team ready to help.

Leave a Reply