Navigating the Affordable Care Act (ACA) and its tax implications can be a complex process. Finding the best tax filing tools for affordable care act compliance can simplify this and ensure accuracy. This article will explore the best tax filing tools available, helping you choose the one that best suits your needs.

Understanding ACA Tax Requirements

The ACA introduced several tax provisions that individuals and businesses need to be aware of. These include the individual mandate (which has been largely eliminated but may still apply in some states), premium tax credits, and employer reporting requirements. Understanding these requirements is crucial for accurate tax filing.

Top Tax Filing Tools for ACA Compliance

Several excellent tax filing tools can help you navigate the ACA’s complexities. Here are some of the best:

- TurboTax: Known for its user-friendly interface, TurboTax guides you through the process step-by-step. It integrates ACA-related questions seamlessly into the filing process, ensuring you don’t miss any important details.

- H&R Block: H&R Block offers both online and in-person tax preparation services. Their software is comprehensive and includes features specifically designed for ACA compliance, such as guidance on premium tax credits.

- TaxAct: TaxAct is a budget-friendly option that doesn’t compromise on features. It provides clear explanations of ACA-related questions and helps you accurately report your health insurance information.

- FreeTaxUSA: As the name suggests, FreeTaxUSA offers free federal filing. While state filing comes at a cost, it’s still a highly affordable option for those looking for ACA compliance assistance.

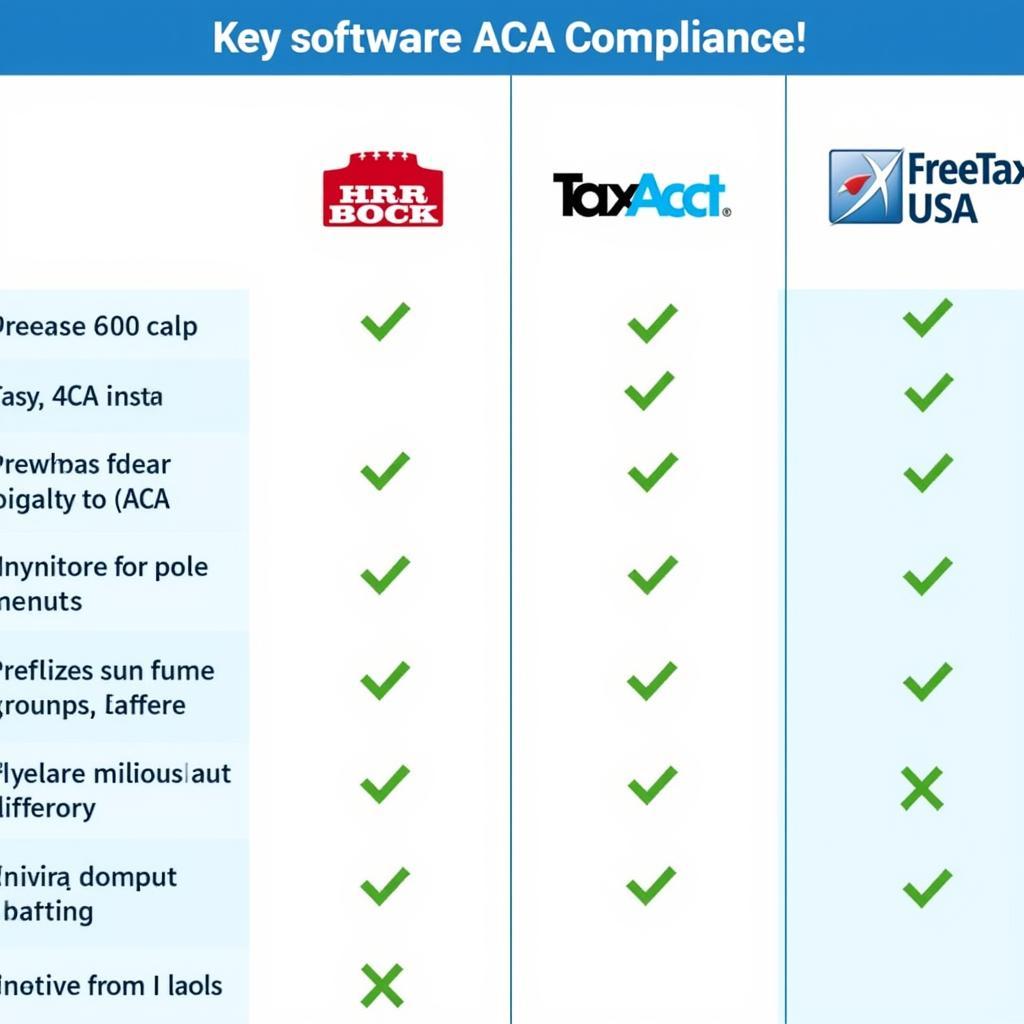

Comparison Chart of Tax Software for ACA Compliance

Comparison Chart of Tax Software for ACA Compliance

Choosing the Right Tool for Your Needs

The “best” tax filing tool depends on your individual circumstances. Consider factors such as your income level, complexity of your tax situation, and comfort level with technology.

What if I’m Self-Employed?

Self-employed individuals face unique ACA challenges. Look for software that specifically addresses self-employment taxes and health insurance deductions.

What if I Received a Premium Tax Credit?

If you received a premium tax credit, ensure the software can accurately reconcile this with your tax liability.

“Choosing the right tool can save you time, money, and headaches,” says John Smith, CPA, a tax expert based in Chicago. “Don’t hesitate to invest in software that provides the support you need.”

Conclusion

Finding the best tax filing tools for affordable care act compliance is crucial for accurate and stress-free tax filing. Consider your individual needs and choose a tool that offers the right level of guidance and support. With the right tool, navigating ACA tax requirements can be significantly less daunting.

FAQ

- What is Form 1095-A?

- What is Form 1095-B?

- What is Form 1095-C?

- What is the individual shared responsibility payment?

- How do I claim the premium tax credit?

- What are the employer reporting requirements under the ACA?

- Where can I find more information about ACA tax provisions?

Need more help? Check out these related articles on our website: “Understanding ACA Tax Forms,” “Guide to Premium Tax Credits,” and “ACA Compliance for Businesses.”

Contact us for support via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 910 Cedar Lane, Chicago, IL 60605, USA. Our customer service team is available 24/7.