Finding the right finance rate for a used car can feel overwhelming. A “Finance Rate For Used Cars Tool” can simplify this process, helping you compare loan offers and make informed decisions. This article explores the benefits of using these tools and offers a comprehensive guide to securing the best possible financing for your next used car purchase.

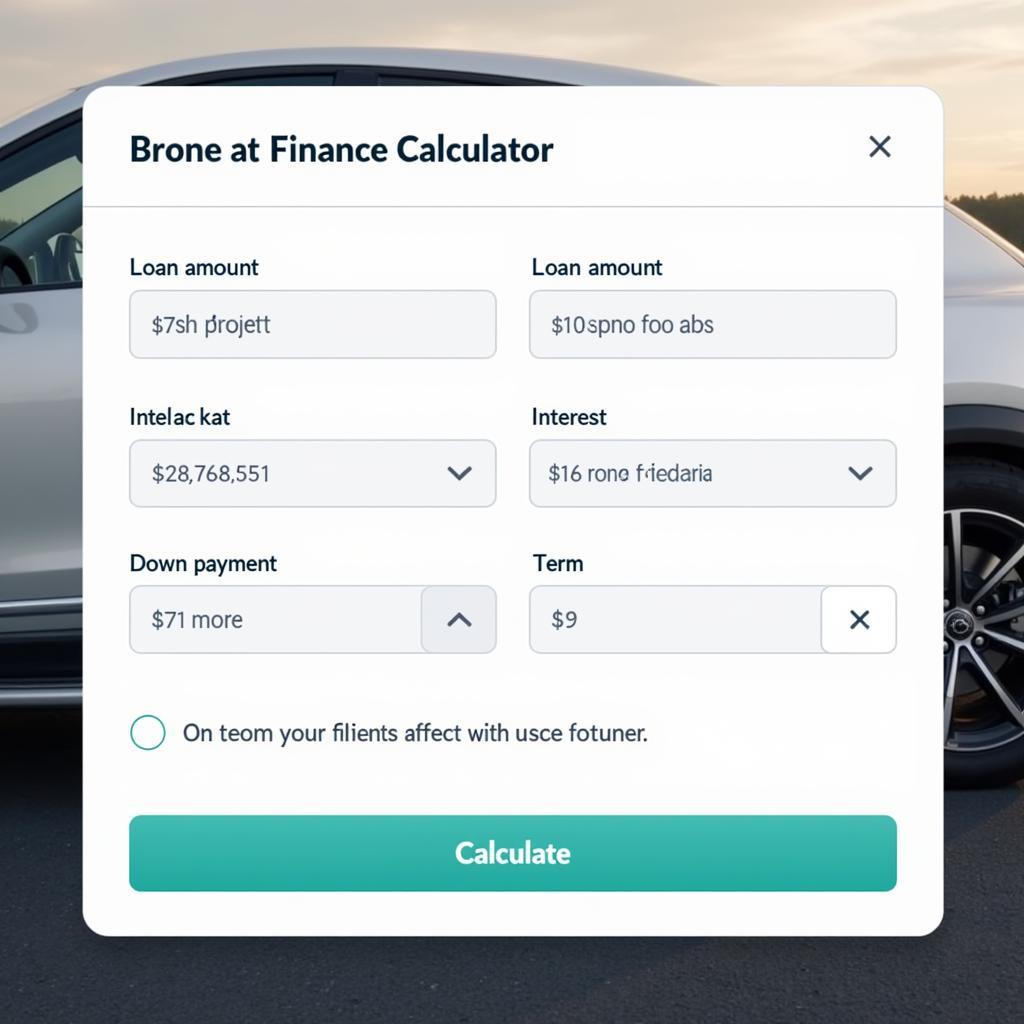

Used Car Finance Calculator

Used Car Finance Calculator

Understanding the Importance of a Good Finance Rate

A lower interest rate translates to lower monthly payments and less interest paid over the life of the loan. Using a finance rate for used cars tool allows you to quickly assess the impact of different interest rates on your budget. These tools empower you to negotiate effectively with lenders and secure a favorable loan. Don’t settle for the first offer you receive; explore your options!

How Finance Rate Calculators Work

These tools typically require you to input information such as the loan amount, loan term, and your credit score. The calculator then estimates your potential interest rate and monthly payments. While these tools provide estimates, they offer a valuable starting point for your car-buying journey. You can explore different scenarios by adjusting the loan term or down payment to see how these changes affect your monthly payments.

Factors Affecting Your Finance Rate

Several factors influence the interest rate you’ll receive on a used car loan. Your credit score is a major factor, with higher scores generally qualifying for lower rates. The loan term also plays a role, with shorter loans often having lower rates but higher monthly payments. The age and mileage of the car can also impact the lender’s risk assessment and therefore the offered interest rate. Understanding these factors helps you prepare and negotiate effectively.

Negotiating the Best Rate

Don’t be afraid to negotiate! Armed with information from a finance rate for used cars tool, you can confidently approach lenders and compare offers. Being pre-approved for a loan from your bank or credit union can give you additional leverage during negotiations. This shows dealerships that you’re a serious buyer with financing already secured. Remember, knowledge is power when it comes to securing the best finance rate. Check out used car buying tools for more resources to help you through this process.

Using a Finance Rate for Used Cars Tool Effectively

Woman Using a Car Finance Tool on Her Phone

Woman Using a Car Finance Tool on Her Phone

To maximize the benefits of these tools, gather all necessary information beforehand, including the price range of the used car you’re considering, your desired loan term, and your estimated credit score. Experiment with different scenarios to understand the impact of various factors on your potential monthly payments. This will help you determine a comfortable budget and avoid financial strain. Consider checking out best used car search tools to help you find the right vehicle. You may also find valuable information on forums like Reddit discussing amazonprime car preaproval tool reddit.

Conclusion

A finance rate for used cars tool is an invaluable resource for anyone looking to purchase a used vehicle. By providing a clear understanding of potential loan terms and monthly payments, these tools empower you to make informed decisions and negotiate confidently with lenders. Utilize these tools to secure the best finance rate possible and drive away in your dream car without breaking the bank. If you are looking for a valuation tool, especially in Australia, check out car valuation tools australia.

FAQ

- What is APR?

- How does my credit score affect my interest rate?

- What is a good interest rate for a used car loan?

- Can I get pre-approved for a loan?

- What is the difference between a fixed and variable interest rate?

- Should I make a larger down payment?

- How do I compare loan offers?

Common Scenarios

- Scenario 1: A young professional with good credit looking to finance a reliable used car for commuting.

- Scenario 2: A family looking to purchase a larger used vehicle with a limited budget.

- Scenario 3: A retiree seeking a low-mileage used car with a short loan term.

Further Reading

For more helpful tools and resources, explore our articles on online car selection tool.

Contact Us

For assistance, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 910 Cedar Lane, Chicago, IL 60605, USA. Our customer service team is available 24/7.

Leave a Reply