Health care finance can feel like a foreign language to non-financial managers. Understanding the basics of health care finance basic tools for non-financial managers is crucial for making informed decisions that contribute to the overall financial health of any healthcare organization. This article will equip you with the foundational knowledge and practical tools you need to navigate this complex landscape effectively.

Decoding the Essentials of Health Care Finance

Financial statements are the cornerstone of healthcare finance. These documents provide a snapshot of an organization’s financial performance. For non-financial managers, understanding key financial statements like the income statement, balance sheet, and statement of cash flows is paramount. These statements help you understand where resources are coming from, how they’re being used, and the overall financial stability of your organization. This knowledge empowers you to make data-driven decisions that align with organizational goals.  Financial Statements Explained for Non-Financial Managers

Financial Statements Explained for Non-Financial Managers

Key Financial Statements Explained

- Income Statement (Profit & Loss Statement): This report shows the revenue generated, expenses incurred, and the resulting profit or loss over a specific period. Understanding this statement allows you to track the profitability of different services and departments.

- Balance Sheet: A snapshot of an organization’s assets, liabilities, and equity at a specific point in time. It provides insights into the organization’s financial position and its ability to meet its obligations.

- Statement of Cash Flows: This statement tracks the movement of cash both into and out of the organization. It helps you understand how cash is being generated and used in operating, investing, and financing activities.

Budgeting and Variance Analysis: Essential Tools for Control

Budgeting and variance analysis are essential tools for non-financial managers to monitor and control expenses. Creating a realistic budget that aligns with organizational strategic goals is crucial. Once a budget is established, regularly comparing actual performance to the budget (variance analysis) is key to identifying areas of overspending or underperformance.

Mastering Variance Analysis

Variance analysis involves comparing actual results against the budgeted figures. Favorable variances indicate better-than-expected performance, while unfavorable variances highlight areas needing attention. Understanding the reasons behind variances enables you to take corrective actions and improve financial outcomes.  Variance Analysis Techniques for Healthcare

Variance Analysis Techniques for Healthcare

health care finance basic tool

Cost Accounting: Understanding the True Cost of Care

Cost accounting is essential for understanding the true cost of providing different services. This information is vital for setting appropriate prices, negotiating with payers, and identifying opportunities for cost reduction.

Key Cost Accounting Concepts

- Cost Allocation: Assigning costs to specific departments or services.

- Cost Drivers: Factors that influence the cost of a service.

- Activity-Based Costing: A more refined approach to cost accounting that assigns costs based on the activities involved in providing a service.

title: baker’s health care finance: basic tools for nonfinancial managers

“Understanding cost drivers is crucial for managing expenses effectively,” says Dr. Maria Sanchez, Chief Financial Officer at Metro Healthcare Systems. “It allows you to pinpoint the root causes of cost variations and implement targeted cost reduction strategies.”

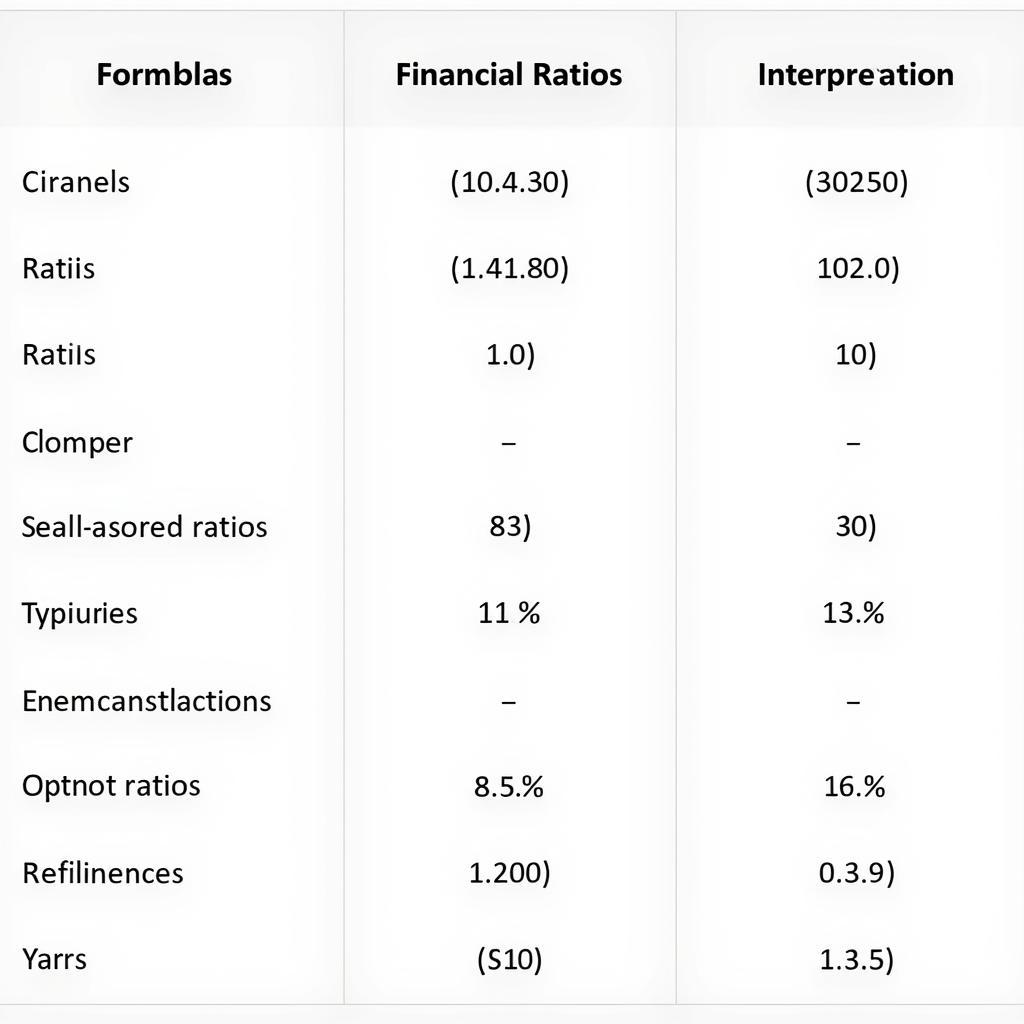

Financial Ratios: Measuring Performance and Benchmarks

Financial ratios are powerful tools for evaluating an organization’s financial health and comparing its performance against industry benchmarks. Key ratios like profitability ratios, liquidity ratios, and solvency ratios provide valuable insights into various aspects of financial performance.

Utilizing Financial Ratios Effectively

Understanding what each ratio represents and how it relates to the overall financial picture is essential. Comparing these ratios to industry averages helps you assess how your organization is performing relative to its peers.  Key Financial Ratios in Healthcare

Key Financial Ratios in Healthcare

health care finance: basic tools for nonfinancial managers pdf

“Financial ratios provide a concise and meaningful way to assess financial health,” adds John Miller, financial analyst at Health Finance Consulting. “They offer a quick snapshot of an organization’s financial strengths and weaknesses.”

Conclusion

Mastering health care finance basic tools for non-financial managers is essential for effective leadership in the healthcare industry. By understanding these key tools and concepts, you can make informed decisions, contribute to the financial success of your organization, and ultimately improve patient care. Start applying these tools today to gain a deeper understanding of your organization’s financial landscape.

snap on tool customer care number

FAQ

- What is the most important financial statement for a non-financial manager to understand?

- How can I use variance analysis to improve financial performance?

- What are the different types of cost accounting methods?

- How do I interpret financial ratios?

- Where can I find industry benchmarks for financial ratios?

- What are the key elements of a budget?

- How can I improve my financial literacy as a non-financial manager?

Commonly Encountered Questions:

- What is the difference between operating expenses and capital expenditures?

- How can I identify areas for cost reduction in my department?

- What are the key financial indicators to monitor in a healthcare organization?

Further Resources:

- Explore our article on “Understanding Healthcare Reimbursement Models”

- Learn more about “Financial Planning for Healthcare Organizations”

If you need further assistance, contact us through WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 910 Cedar Lane, Chicago, IL 60605, USA. Our customer service team is available 24/7.

Leave a Reply